News & Blogs

Essential Tips for Commercial Hurricane Season Prep

The 2025 hurricane season is approaching, and for business owners, preparation is key to safeguarding commercial properties and maintaining operations. The Atlantic hurricane season runs from June...

Read more

Key Financial Terms for Financial Literacy Month

April marks Financial Literacy Month, a time dedicated to increasing our understanding of essential financial concepts. Grasping these terms not only empowers us but also sets the foundation for...

Read more

Celebrating Employee Benefits: A Key to Success

National Employee Benefits Day on April 2 marks an important time for organizations to reflect on their benefits packages and consider how these offerings contribute to the well-being, productivity...

Read more

Maximize Your Tax Benefits with IRAs and HSAs

With Tax Day fast approaching, it's time to take stock of opportunities to reduce your tax burden and grow your savings. Two often-overlooked tools—the Individual Retirement Account (IRA) and the...

Read more

IRS vs. Accountants: Who to Call for Tax Help

Many individuals and business owners often find themselves confused about whether to contact the IRS or an accountant for their tax-related issues. While both play crucial roles in navigating the...

Read more

Tax Benefits of Home Ownership: Maximizing Your Savings

Beyond the pride of owning a home, there are significant financial benefits that come with it, especially during tax season. Navigating these benefits doesn't have to be overwhelming, even amidst...

Read more

Understanding the Social Security Fairness Act: Key Changes for Retirees

The Dawn of a New Era for Public ServantsOn January 5, 2025, a landmark legislative change occurred that sent ripples of relief through the retiree community: the Social Security Fairness Act was...

Read more

Unlock Tax Benefits of Homeownership Today

Beyond the pride and joy of owning a home, there are significant financial benefits that come with it, especially during tax season. Navigating these benefits can sometimes be overwhelming due to...

Read more

Maximize Your Open House Visits: Top Dos and Don’ts

Searching for the perfect home and attending open houses can be both exciting and stressful. It’s important to be prepared and respectful throughout the process. Knowing the dos and don’ts can...

Read more

Tax Implications and Benefits of Homeownership

Beyond the pride of owning a home, there's a wealth of financial benefits, particularly during tax season. Navigating these perks can be daunting, but understanding them can unlock significant...

Read more

What to Know About the Social Security Fairness Act

The Social Security Fairness Act: A New Era for RetireesThe signing of the Social Security Fairness Act into law on January 5, 2025, marks a transformative moment for millions of retirees,...

Read more

January 2025: Financial Markets and Economy Overview

Overview of January's Financial LandscapeThe start of 2025 was marked by significant activity in the financial markets, reflecting resilience with a touch of volatility. Following the presidential...

Read more

Navigate Financial Wellness Month in 2025

January 2025 marks Financial Wellness Month, offering a golden opportunity for individuals to take control of their financial well-being. As the year begins, it's an ideal moment to reflect on...

Read more

Decoding Roth vs. Traditional IRAs for Retirement

Imagine you’re planning for your retirement, contemplating which investment vehicle will navigate your financial future. Choosing between a Roth IRA and a Traditional IRA can be daunting, yet...

Read more

Practical Tips to Steer Clear of Small Business Audits

We understand that just the thought of an IRS audit can send shivers down the spine of any small business owner. Audits, although daunting, are often avoidable with meticulous planning and...

Read more

Preparing for a Rainy Day with Emergency Funds

Imagine an unexpected downpour on a sunny day, with not an umbrella in sight. When life throws unexpected financial demands your way, having an emergency fund is like having that essential umbrella...

Read more

Alternatives to Tapping Your Retirement Savings for Debt Relief

In today's economic climate, with record inflation and a looming recession, financial stress is at an all-time high. The average credit card debt in early 2022 reached $9,000 per household, leading...

Read more

IRS vs. Accountants: Who to Call

Many people struggle with whether to contact the IRS or an accountant for tax-related issues. While the IRS is fundamental for specific concerns, accountants play a pivotal role in personal and...

Read more

10 Payroll Terms Every Business Owner Should Know

Managing payroll is one of the most critical and complex tasks for business owners. Mastering payroll terminology not only simplifies the process but also ensures legal compliance and boosts...

Read more

10 Essential EOY Questions for Business Owners

Many business owners find themselves juggling multiple tasks at the end of the year as they try to close out their financials. Asking the right end-of-year (EOY) questions can reduce stress, help...

Read more

The Growing Importance of Family-Friendly Benefits at Work

The priorities of employees have shifted significantly in recent years. More individuals are now seeking workplaces that recognize and support their familial needs. Family-friendly benefits are no...

Read more

Choosing Between Roth IRA and Traditional IRA: A Comprehensive Guide

Choosing Between Roth IRA and Traditional IRA: A Comprehensive GuideImagine you are considering your options for retirement savings, navigating through different investment avenues. The decision...

Read more

The Importance of Family-Friendly Benefits in the Workplace

In today’s dynamic work environment, a significant shift in employee priorities is noticeable. More people now seek workplaces that acknowledge and support their family needs. Family-friendly...

Read more

Balancing Employee Benefits: A Strategic Guide

In today’s competitive job market, offering employee benefits can feel like a complex puzzle. Understanding the different types of benefits—legally required, industry-standard, and fringe—can help...

Read more

Thanksgiving's Financial Impact on the Economy

Thanksgiving's Financial Impact on the EconomyThanksgiving is a cherished holiday in the United States, known for bringing families together, celebrating gratitude, and enjoying hearty meals....

Read more

Why Using Retirement Funds Now Could Hurt You Later

The current economic landscape is fraught with challenges. Record inflation and a potential recession weigh heavily on many households. With the average U.S. household facing approximately $9,000...

Read more

What Employers Should Know About 401(k) Vesting Schedules

401(k) plans are an essential benefit for attracting and retaining top talent. In fact, 88% of employees see a 401(k) plan as a must-have benefit when evaluating potential jobs. Employers need to...

Read more

Wealth Management Meets the High-Net-Worth Lifestyle

Real Estate Dynamics: Strategic Investments for Luxury LifestylesWe have seen the dynamics of the real estate market shift dramatically since 2020. Hedge funds, other institutions, and even foreign...

Read more

Investing 101: Taking Your First Steps Towards Financial Independence

Many Americans feel apprehensive about entering the world of investing, often thinking it's a game solely for the wealthy or financially savvy. However, starting to invest is a significant step...

Read more

Is $1 Million Enough for Retirement in Today's World?

For many years, the concept of accumulating $1 million for retirement has been synonymous with financial security and readiness. This idea has provided a clear, albeit ambitious, goal for...

Read more

Understanding U.S. Election Impact on Financial Markets: Insights from 2020 and Beyond

Understanding U.S. Election Impact on Financial Markets: Insights from 2020 and BeyondAs we approach the 2024 election, a look back at recent elections provides insights into how financial markets...

Read more

IRS Offers Tax Relief for Hurricane Helene Victims

Hurricane Helene has been devastating for individuals and businesses alike, causing significant physical, emotional, and financial harm. Recognizing this, the IRS has stepped in with tax relief...

Read more

May Market Analysis

U.S. Equity Indexes Experience a Dip in April After a robust performance in March, U.S. equity markets experienced a decline throughout April. The primary drivers for...

Read more

Demystifying Cryptocurrency: Understanding the Basics and Beyond

Demystifying Cryptocurrency: Understanding the Basics and Beyond In the world of finance, cryptocurrency has become a buzzword synonymous with digital innovation and investment...

Read more

Maximizing Your 401(k): Strategic Tips for Optimal Retirement Savings

Maximizing Your 401(k): Strategic Tips for Optimal Retirement Savings As retirement approaches, the importance of a well-managed 401(k) plan cannot be overstated. This tax...

Read more

April Market Analysis

In March, the stock market saw a notable continuation of the rally that began last November, suggesting an optimistic turn as more sectors participated in the gains. This shift was supported by a...

Read more

March Market Analysis

In the past few months, disciplined and goal-focused investors have experienced rewarding times. The influence of artificial intelligence (AI) on major U.S. stock indexes has been significant,...

Read more

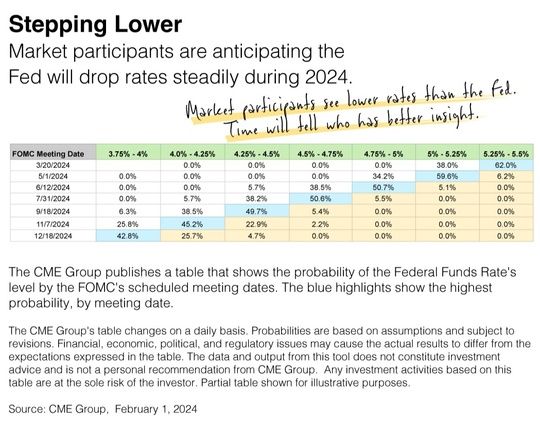

Cloudy Rate Outlook Invites Volatility FEB 27 2024

I can't remember the last time there was such a wide divergence in the outlook for short-term interest rates. But, some confusion is to be expected when the Federal Reserve primes the markets for...

Read more

Gen Z, Millennial Couples Prefer Financial Autonomy

Over the years, I've come to believe that learning to navigate financial discussions and events in a relationship is a "must" that transcends generations. However, recent data shows that Gen Z and...

Read more

February Market Analysis

As January wrapped up, it was evident that broad market indexes and tech stock investors have been steering the course since November. The concluding Federal Reserve (Fed) meeting of the month...

Read more

January Market Update

As 2023 drew to a close, the U.S. stock market demonstrated robust performance, extending gains for the second consecutive month. The rally that kicked off in October continued through December,...

Read more

December Market Update

November proved to be a pivotal month for long-term investors in the U.S. stock market, marking a significant turnaround from October's dynamics. Impressive Gains in...

Read more